The Capitol Forum, ProPublica win April Sidney for Exposing Cigna’s Policy of Rejecting Health Insurance Claims Without Reading Them

Patrick Rucker of The Capitol Forum and Maya Miller and David Armstrong of ProPublica win the April Sidney Award for exposing Cigna’s policy of rejecting health insurance claims without opening their files in a co-published investigation.

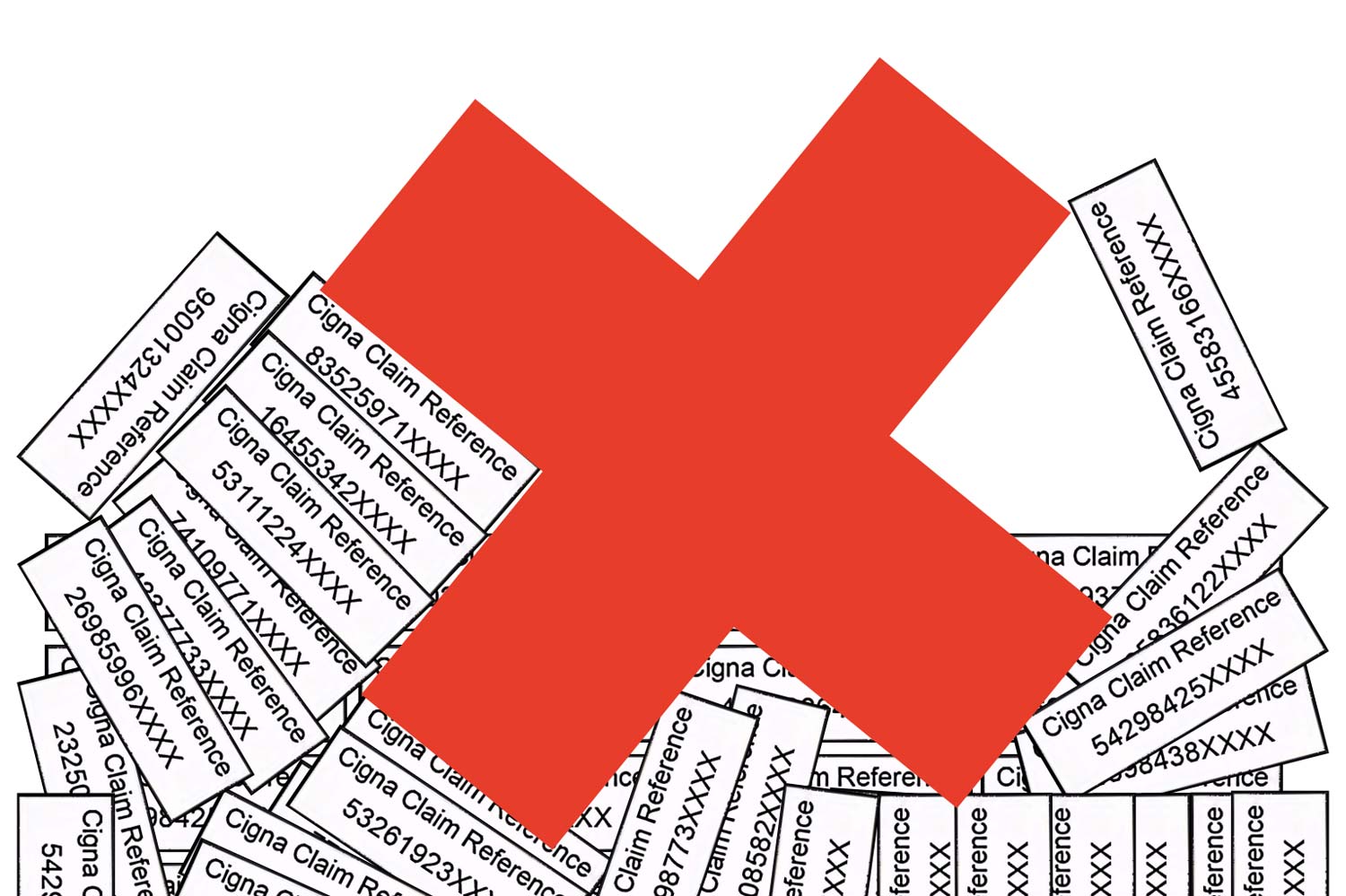

Over two months in 2022, Cigna doctors rejected over 300,000 claims, spending an average of 1.2 seconds on each. How is this possible? Cigna, which administers the health insurance plans of 18 million people, created an “auto-denial” computer system that allows its doctors to reject a claim on “medical grounds” without even opening the patient’s file.

Insurance company doctors are required by law to review case files and use their professional judgment to decide what’s medically necessary. However, according to former Cigna employees, the company outsourced the determination to an algorithm, which flags mismatches between diagnoses and Cigna-approved treatments. The company doctor’s only role is to click “send” on batches of claims.

“We literally click and submit,” one former Cigna doctor told the reporters. “It takes all of 10 seconds to do 50 at a time.”

This algorithmic review happens after care has already been delivered, leaving unsuspecting patients stuck with surprise bills.

A doctor whose own claim was suspiciously denied pushed forward with a series of appeals but Cigna, and other insurers, know that most people will give up and pay. They expect only 5% to appeal.

“This investigation impressed our judges with its originality and depth of reporting,” said Sidney judge Lindsay Beyerstein, “This story challenges the states to protect consumers from the predatory use of health insurance algorithms in place of professional judgment.”

Patrick Rucker is a financial reporter for The Capitol Forum. As a foreign correspondent, Rucker reported from Havana for the Financial Times and Mexico City for Reuters.

Maya Miller is an engagement reporter at ProPublica working on community-sourced investigations. Her reporting focuses on health care, environmental health and housing.

David Armstrong is a reporter at ProPublica, specializing in health care investigations. He joined ProPublica in March 2018.

Backstory

Q: How did you figure out that Cigna was declining claims without reading them?

A: Health insurance companies deny millions of claims a year. The process is often dizzying and murky. Patients often receive news of the denial in short, jargon-laden notices. It’s frustrating for patients. The process does not sit well with many insiders, either. We heard from Cigna employees who felt the auto-denial system was particularly unfair - and that Cigna is not alone in using such a process. Once we saw Cigna documents, it was pretty stark.

Q: Walk us through the documents that helped you report this story.

A: Like many corporations, Cigna is highly bureaucratic. The company carefully tracks productivity. Doctors who review claims for Cigna - specialists known as ‘medical directors’ - are closely monitored to see how fast they can churn through claims. The monthly productivity reports were eye opening. Medical directors denying tens of thousands of claims a month. Spending less than 2 seconds on each case. That is the kind of detail that Cigna shared with its workers and we were able to obtain those telling documents.

Q: Can you elaborate on which laws Cigna might be breaking by denying claims without reading them?

A: The health insurance industry is largely regulated by states which broadly agree that only a medical director can deny a claim. If your doctor decides that you need certain care, the insurer needs to find an equally-qualified doctor to say “no.” There is supposed to be an even playing-field. That’s the idea.

Medical directors are expected to give each case care and attention. We’ve spoken to no one who sees how a medical director can give a meaningful review in less than 2 seconds. It bears repeating, Cigna is not alone. UnitedHealthcare has a similar review system that was crafted by the same architect of Cigna’s, and we believe there are others. What happens next is really up to state regulators, lawmakers and policymakers in Washington DC. The laws vary but from what we have seen, regulators have ample power to get answers from Cigna and other insurers.

Q: What advice would you give to a reporter who seeks to report on health insurance?

A: These are highly-specialized fields - insurance and medicine. It’s helpful to be familiar with the language but don’t lose sight of the big picture. Is this system actually legal? Is it open and transparent? Those are the questions we kept asking.

It is useful to keep eyes open for the insider language that frames the big picture.

The auto-deny program at Cigna has a specific name: PXDX. Once we knew that, we could find traces of the program online and in Cigna documents.

Q: Did anything funny or unexpected happen in the course of reporting this story?

A: One key document we found - a confidential slide deck from Cigna - was just lying around on the internet. A Cigna employee posted it, we presume, because he was proud of the work. That document counted out the dollars Cigna expected to save by using PXDX, the auto-deny tool, for a specific set of tests. It was a reminder to us that confidential documents can go squirting out in all directions on the internet these days.

Q: Every successful investigation teaches you something that you’ll carry forward to your next assignment. What did you learn from this one?

A: Good sources are found in the middle-rungs of the corporate ladder. Those insiders are sophisticated enough to understand the whole picture without being responsible for it all.